Los Angeles County CA Property Taxes: Your Ultimate Guide To Understanding And Managing

Property taxes in Los Angeles County, CA, are a crucial part of owning real estate in this vibrant region. Whether you're a first-time homeowner or a seasoned property investor, understanding how these taxes work is essential. They play a significant role in funding public services and infrastructure, impacting both your finances and the community at large. So, buckle up, folks, because we're diving deep into the world of LA County property taxes, where knowledge is power, and power saves you money!

Let’s face it—property taxes are one of those topics that make people’s eyes glaze over faster than a donut at a Sunday brunch. But here’s the deal: if you own property in Los Angeles County, this is something you need to wrap your head around. It’s not just about paying a bill every year; it’s about understanding how those dollars contribute to the community and how you can manage them effectively.

In this article, we’ll break down everything you need to know about Los Angeles County CA property taxes. From how they’re calculated to potential exemptions and ways to appeal, we’ve got you covered. So grab your coffee, sit back, and let’s demystify the world of property taxes together.

Here's the table of contents to help you navigate:

- Biography

- How Property Taxes Are Calculated

- Property Tax Rates in LA County

- Exemptions and Deductions

- Paying Your Property Taxes

- Appealing Your Property Tax Assessment

- Property Tax History in LA County

- Common Questions About Property Taxes

- Tax Relief Programs

- Tips for Property Owners

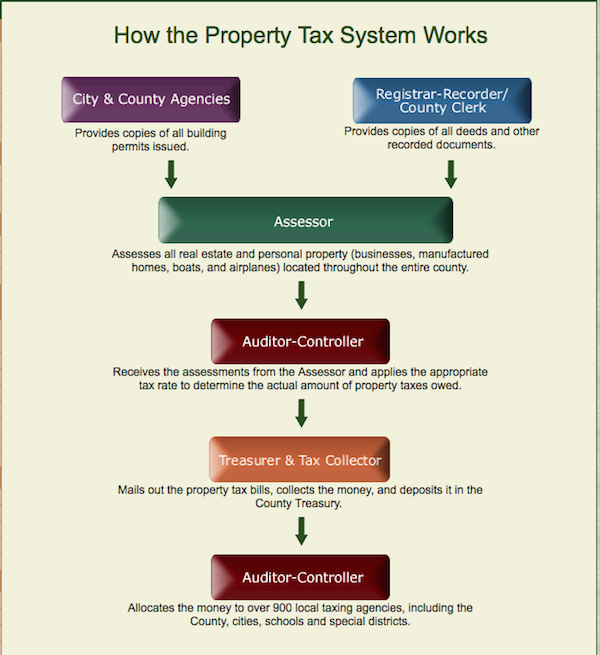

How Property Taxes Are Calculated

Alright, let’s get down to the nitty-gritty of how property taxes are calculated in Los Angeles County. It’s not rocket science, but it does involve a few steps that you should understand. The basic formula is pretty straightforward: your property's assessed value multiplied by the tax rate equals your property tax bill. But, there’s more to it than just crunching numbers.

First off, the assessed value of your property is determined by the county assessor. This value is usually based on the market value of your property when it was last purchased, adjusted annually for inflation. However, thanks to Proposition 13, which we’ll dive into later, the increase in assessed value is capped at 2% per year unless there’s a change in ownership or new construction.

Now, here’s where it gets interesting. The tax rate itself is made up of several components, including the general tax rate, which is set by the state at 1%, and any additional rates for local assessments, bonds, and special districts. These additional rates can vary depending on where your property is located within the county.

Key Factors in Property Tax Calculation

- Assessed Value: Determined by the county assessor and capped by Proposition 13.

- Tax Rate: Comprises the base rate of 1% plus any additional local assessments.

- Location: Property taxes can differ based on the specific area within LA County.

Property Tax Rates in LA County

So, what exactly are the property tax rates in Los Angeles County? As of the latest data, the effective tax rate averages around 1.25%, but this can vary. The base rate is set at 1%, but additional assessments, such as those for school bonds or community facilities, can push the rate higher.

It’s important to note that these rates are subject to change, and new assessments or bonds can be added through local elections. For instance, Measure RR, a school bond measure approved by voters in 2020, added an additional tax levy for certain properties. Always stay updated with local elections and ballot measures that might impact your property taxes.

Breakdown of Tax Rates

- Base Rate: 1% of assessed value.

- Additional Assessments: Vary by location and can include school bonds, community facilities, and other local levies.

Exemptions and Deductions

Now, let’s talk about the good stuff—exemptions and deductions. There are several ways you can reduce your property tax bill in Los Angeles County. One of the most common is the Homeowners’ Exemption, which provides a $7,000 reduction in assessed value for primary residences. This can translate to significant savings on your tax bill.

Additionally, there are exemptions for seniors, disabled individuals, and those who have suffered a natural disaster. For example, the Disabled Veterans’ Exemption can provide substantial relief for eligible veterans. It’s worth exploring these options to see if you qualify for any reductions.

Common Exemptions

- Homeowners’ Exemption: $7,000 reduction for primary residences.

- Senior Exemption: Available for homeowners over 55 with limited income.

- Disaster Area Exemption: For properties affected by natural disasters.

Paying Your Property Taxes

When it comes to paying your property taxes, LA County makes it relatively easy. Property taxes are typically billed twice a year, with payment due dates in November and February. You have the option to pay online, by mail, or even in person at the county tax collector’s office.

One thing to keep in mind is that there are penalties for late payments. If you miss the deadline, you could face a 10% penalty on the unpaid amount, so it’s crucial to stay on top of your payments. Setting up automatic payments or reminders can help ensure you never miss a deadline.

Payment Options

- Online Payment: Convenient and secure through the county’s website.

- Mail: Send a check to the tax collector’s office.

- In Person: Visit the county tax collector’s office during business hours.

Appealing Your Property Tax Assessment

If you believe your property tax assessment is inaccurate, you have the right to appeal. The process starts with filing an Assessment Appeal Application with the Los Angeles County Assessment Appeals Board. You’ll need to provide evidence to support your claim, such as recent property sales in your area or an appraisal.

It’s important to act quickly, as there are deadlines for filing appeals. Typically, you have until September 15th to file an appeal for the current fiscal year. The board will review your case and may schedule a hearing if necessary. If the appeal is successful, your assessed value could be adjusted, resulting in lower property taxes.

Steps to Appeal

- File an Assessment Appeal Application by September 15th.

- Provide evidence, such as recent property sales or an appraisal.

- Attend a hearing if scheduled by the appeals board.

Property Tax History in LA County

The history of property taxes in Los Angeles County is deeply rooted in California’s tax policies. One of the most significant developments was the passage of Proposition 13 in 1978, which capped property tax increases and required a two-thirds majority for new local taxes. This measure had a profound impact on property taxes across the state, including LA County.

Since then, there have been numerous changes and additions to the tax structure, including various bond measures and assessments. Understanding this history can help you better grasp how property taxes have evolved and why they are structured the way they are today.

Key Historical Developments

- Proposition 13 (1978): Capped property tax increases at 2% annually.

- Measure RR (2020): Added additional tax levy for school bonds.

Common Questions About Property Taxes

Let’s address some of the most common questions people have about property taxes in Los Angeles County. Whether you’re wondering about payment deadlines, exemptions, or how to appeal, we’ve got answers for you.

FAQs

- When are property taxes due? Property taxes are billed twice a year, with payment due dates in November and February.

- Can I appeal my property tax assessment? Yes, you can file an appeal with the Los Angeles County Assessment Appeals Board by September 15th.

- What exemptions are available? Common exemptions include the Homeowners’ Exemption, Senior Exemption, and Disabled Veterans’ Exemption.

Tax Relief Programs

For those struggling to pay their property taxes, there are several tax relief programs available in Los Angeles County. The Property Tax Postponement Program, for example, allows seniors and disabled individuals with limited income to defer their property tax payments. This can provide much-needed financial relief for those who qualify.

Additionally, the Supplemental Property Tax Assistance Program offers assistance to low-income homeowners who are struggling to pay their supplemental property tax bills. It’s worth exploring these programs to see if you qualify for any form of relief.

Available Programs

- Property Tax Postponement Program: For seniors and disabled individuals with limited income.

- Supplemental Property Tax Assistance Program: For low-income homeowners facing supplemental tax bills.

Tips for Property Owners

As a property owner in Los Angeles County, there are several tips you can follow to manage your property taxes effectively. First and foremost, stay informed about any changes in tax rates or assessments. Regularly check your property’s assessed value and compare it to similar properties in your area.

Consider filing an appeal if you believe your assessment is inaccurate. Keep track of payment deadlines and set up reminders to avoid late penalties. Lastly, explore any available exemptions or relief programs that you might qualify for. By staying proactive, you can ensure that you’re paying the right amount and taking advantage of all available savings.

Key Tips

- Stay informed about changes in tax rates and assessments.

- File an appeal if you believe your assessment is inaccurate.

- Set up reminders for payment deadlines to avoid late penalties.

Kesimpulan

Understanding Los Angeles County CA property taxes is an essential part of being a responsible property owner. From how they’re calculated to available exemptions and ways to appeal, there’s a lot to consider. By staying informed and proactive, you can manage your property taxes effectively and ensure that you’re paying the right amount.

We encourage you to take action by exploring any available exemptions, filing appeals if necessary, and staying updated on local tax policies. Don’t forget to share this article with fellow property owners or leave a comment below if you have any questions or insights to share. Together, let’s navigate the world of property taxes with confidence and clarity!

Detail Author:

- Name : Ken Hintz

- Username : dickens.cory

- Email : ethyl.keebler@nolan.com

- Birthdate : 1971-06-08

- Address : 230 Leif Isle Suite 795 New Chazchester, FL 59298-6691

- Phone : +1-504-935-6471

- Company : O'Keefe-Bauch

- Job : Electric Motor Repairer

- Bio : Impedit et porro ut iusto sit itaque. Pariatur omnis nam suscipit dolore voluptas est sapiente. Nobis dolorum itaque doloremque dolores exercitationem. Dolores asperiores quam a ducimus quia.

Socials

facebook:

- url : https://facebook.com/toy2008

- username : toy2008

- bio : Animi provident cumque non cum nesciunt quis.

- followers : 2887

- following : 2589

linkedin:

- url : https://linkedin.com/in/soledad_toy

- username : soledad_toy

- bio : Nemo tempora laboriosam neque rerum omnis.

- followers : 1440

- following : 2953

tiktok:

- url : https://tiktok.com/@stoy

- username : stoy

- bio : Est harum maiores recusandae nobis. Qui reiciendis unde aut ipsa laboriosam.

- followers : 4253

- following : 2457

instagram:

- url : https://instagram.com/toys

- username : toys

- bio : Rerum voluptate magni magni iure. Sit molestiae perspiciatis voluptatem est quas.

- followers : 755

- following : 1549