Netspend Activate: The Ultimate Guide To Unlocking Your Prepaid Card

Hey there, card enthusiasts! If you're reading this, chances are you've got a Netspend prepaid card in your pocket and you're wondering how to get it up and running. Don't sweat it—we've got you covered. Netspend activate is easier than you think, and we're about to break it down step by step so you can start using your card like a pro. Whether you're new to the prepaid game or just need a refresher, this guide is here to help you out big time.

Now, I know what you're thinking—why do I even need to activate my Netspend card? Great question, my friend. Activation is like flipping the switch that turns your card from a piece of plastic into a powerful financial tool. Without activation, your card is basically just sitting there, collecting dust. But once you activate it, you've got access to all the sweet perks that come with Netspend, like direct deposit, bill pay, and more.

So, let's not waste any time. We're diving deep into the world of Netspend activate, uncovering everything you need to know to get your card ready for action. From step-by-step activation instructions to troubleshooting tips, we've got all the bases covered. Let's get started!

Why You Need to Activate Your Netspend Card

Alright, let's talk about why activation is such a big deal. When you activate your Netspend card, you're basically telling the system, "Hey, this card is legit, and I'm ready to roll." Without activation, your card is like a car without gas—it's not going anywhere. Activation sets everything in motion, allowing you to load funds, make purchases, and access all the features that make Netspend so awesome.

Here's the kicker: activation also helps protect you from fraud. By verifying your identity during the activation process, Netspend ensures that only you can use the card. It's like putting a lock on your financial front door. Plus, once your card is activated, you can take advantage of features like mobile banking, which lets you manage your money on the go. Pretty sweet, right?

Step-by-Step Guide to Netspend Activate

Now that you know why activation is important, let's dive into the nitty-gritty of how to actually do it. Don't worry—it's super easy, and we'll walk you through it step by step. Whether you're activating your card online or over the phone, we've got all the info you need.

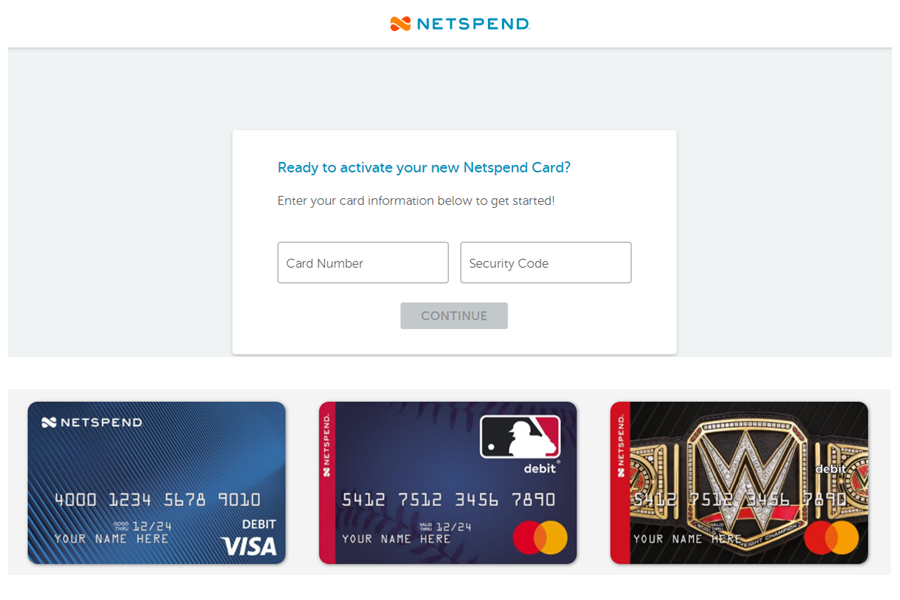

Activating Your Netspend Card Online

The easiest way to activate your Netspend card is through the official Netspend website. Here's how you do it:

- Head over to the Netspend website and click on the "Activate Card" button.

- Enter the 16-digit card number located on the front of your card.

- Provide your ZIP code and the CVV number on the back of the card.

- Create a username and password for your Netspend account.

- Set up security questions to keep your account safe.

- That's it! Your card is now activated and ready to use.

See? Piece of cake. And the best part? Once you're logged in, you can start managing your account right away. You can check your balance, view transactions, and even set up direct deposit.

Activating Your Netspend Card Over the Phone

If you're not into the whole online thing, you can also activate your card over the phone. Just dial the toll-free number on the back of your card and follow these steps:

- Call the activation hotline and select the activation option.

- Enter your 16-digit card number when prompted.

- Provide your ZIP code and the CVV number.

- Answer a few security questions to verify your identity.

- Follow the prompts to complete the activation process.

Boom! Your card is now activated, and you're good to go. Plus, if you have any questions or run into issues, you can speak to a live representative who can help you out.

Understanding Netspend Features After Activation

Once your card is activated, you've got access to a whole host of features that make managing your money a breeze. Let's break down some of the key features you'll enjoy:

- Direct Deposit: Get paid faster by setting up direct deposit for your paycheck.

- Bill Pay: Pay your bills directly from your Netspend account.

- Mobile Banking: Manage your account on the go with the Netspend app.

- ATM Access: Withdraw cash from thousands of ATMs nationwide.

- Text Alerts: Stay on top of your account activity with text notifications.

These features make Netspend so much more than just a prepaid card. It's like having a mini bank in your pocket.

Common Issues During Netspend Activate and How to Fix Them

Let's face it—sometimes things don't go as planned. If you run into issues during the activation process, don't panic. We've got some troubleshooting tips to help you out:

- Wrong Card Number: Double-check that you're entering the correct 16-digit number.

- Incorrect ZIP Code: Make sure the ZIP code you're entering matches the one on your card.

- CVV Issues: Ensure you're entering the three-digit code on the back of the card correctly.

- System Errors: Try again later or activate over the phone if you're having trouble online.

If none of these solutions work, don't hesitate to reach out to Netspend customer service. They're there to help you get your card up and running.

Benefits of Using Netspend After Activation

So, why should you choose Netspend over other prepaid cards? Let's take a look at some of the benefits:

- No Credit Check: Netspend doesn't require a credit check to get started.

- Low Fees: Compared to other prepaid cards, Netspend offers competitive fees.

- Wide Acceptance: Use your Netspend card wherever Visa or Mastercard is accepted.

- Customer Support: Netspend offers 24/7 customer service to assist you.

These benefits make Netspend a solid choice for anyone looking for a reliable prepaid card solution.

Tips for Maximizing Your Netspend Experience

Now that your card is activated, here are a few tips to help you make the most of your Netspend experience:

- Set Up Direct Deposit: Get your paycheck faster and avoid check-cashing fees.

- Use the App: Stay on top of your finances with the Netspend mobile app.

- Track Expenses: Monitor your spending to stay within budget.

- Explore Perks: Check out any special offers or discounts available to Netspend users.

By following these tips, you'll be well on your way to mastering your Netspend card.

Security Measures to Protect Your Netspend Card

Security is a top priority when it comes to your finances. Here are some steps you can take to keep your Netspend card safe:

- Create a Strong Password: Use a mix of letters, numbers, and symbols for your account password.

- Enable Two-Factor Authentication: Add an extra layer of security to your account.

- Monitor Transactions: Regularly check your account for any suspicious activity.

- Report Lost or Stolen Cards: Contact Netspend immediately if your card goes missing.

By taking these precautions, you can rest easy knowing your money is protected.

Comparing Netspend to Other Prepaid Cards

There are plenty of prepaid card options out there, so how does Netspend stack up? Here's a quick comparison:

- Fees: Netspend offers competitive fees compared to other prepaid cards.

- Features: Netspend provides a wide range of features, including mobile banking and bill pay.

- Security: Netspend takes security seriously, offering tools like two-factor authentication.

- Customer Service: Netspend provides 24/7 support to help you with any issues.

When you weigh the pros and cons, Netspend is a strong contender in the prepaid card market.

Frequently Asked Questions About Netspend Activate

Got questions? We've got answers. Here are some of the most common questions about Netspend activation:

- Can I activate my card at a retail location? No, you must activate your card online or over the phone.

- How long does activation take? Activation typically takes just a few minutes.

- What if I forget my password? You can reset your password through the Netspend website.

- Can I use my Netspend card internationally? Yes, but be aware of any foreign transaction fees.

These FAQs should help clear up any confusion you might have about the activation process.

Conclusion: Take Control of Your Finances with Netspend Activate

Well, there you have it—the ultimate guide to Netspend activate. From understanding why activation is important to troubleshooting common issues, we've covered everything you need to know to get your card up and running. Netspend offers a ton of great features that make managing your money easier than ever, and with a few simple steps, you can unlock all the benefits this prepaid card has to offer.

So, what are you waiting for? Head over to the Netspend website or dial the activation hotline and get your card activated today. And don't forget to share this guide with your friends who might be wondering how to activate their Netspend cards. Together, let's take control of our finances and make the most of what Netspend has to offer!

Table of Contents

- Why You Need to Activate Your Netspend Card

- Step-by-Step Guide to Netspend Activate

- Activating Your Netspend Card Online

- Activating Your Netspend Card Over the Phone

- Understanding Netspend Features After Activation

- Common Issues During Netspend Activate and How to Fix Them

- Benefits of Using Netspend After Activation

- Tips for Maximizing Your Netspend Experience

- Security Measures to Protect Your Netspend Card

- Comparing Netspend to Other Prepaid Cards

- Frequently Asked Questions About Netspend Activate

:max_bytes(150000):strip_icc()/how-do-you-cancel-netspend-card.asp-Final-d388de614474410cad24f9c3a4e4e9f0.jpg)

Detail Author:

- Name : Orpha Goldner V

- Username : zrodriguez

- Email : aboyer@connelly.com

- Birthdate : 1978-07-26

- Address : 496 Chance Greens Apt. 274 East Katelynnland, MA 00914

- Phone : (947) 977-3763

- Company : Rippin-Koss

- Job : Physician

- Bio : Ratione repellat aut eaque eius iusto. Et non natus quisquam eum cumque.

Socials

instagram:

- url : https://instagram.com/morissette2001

- username : morissette2001

- bio : Molestiae quod rerum corporis culpa aut labore accusamus. Quia nulla unde nulla cum.

- followers : 5925

- following : 26

facebook:

- url : https://facebook.com/morissettee

- username : morissettee

- bio : Id qui assumenda illo autem.

- followers : 2818

- following : 2903

linkedin:

- url : https://linkedin.com/in/emorissette

- username : emorissette

- bio : Enim ducimus quasi repudiandae tempora ut illo.

- followers : 4561

- following : 2220