How To Access And Understand Your Kelly Services Paystub: The Ultimate Guide

Let’s talk about something that affects your wallet and your peace of mind—your Kelly Services paystub. Whether you’re a seasoned temp worker or just starting out, understanding your paystub is crucial. It’s not just a piece of paper (or a digital file); it’s your financial snapshot, showing how much you’re earning, what’s being deducted, and where your money is going. So, buckle up because we’re diving deep into the world of Kelly Services paystubs, and by the end of this guide, you’ll be a pro at deciphering every line.

Look, nobody likes surprises when it comes to paychecks. That’s why knowing how to access and interpret your Kelly Services paystub is key. Whether you’re trying to figure out why your net pay seems lower than expected or you just want to ensure everything adds up, this article has got you covered. Think of it as a treasure map for your earnings—except instead of gold, you’re hunting down clarity.

We’re going straight to the heart of the matter here. Your Kelly Services paystub isn’t just a number on a screen; it’s a breakdown of your hard work and the financial details that come with it. So, let’s break it down step by step, make sense of those numbers, and ensure you’re getting exactly what you deserve. Let’s get started, shall we?

Why Understanding Your Kelly Services Paystub Matters

Now, you might be thinking, “Why should I care about my paystub? I just want my money.” But here’s the thing: your paystub is more than just a record of your earnings. It’s a legal document that shows how much you’re paid, any deductions, and important tax information. Ignoring it could mean missing out on errors that could cost you big time. Plus, it’s super handy for things like applying for loans, filing taxes, or proving your income.

Common Misconceptions About Paystubs

There are a lot of myths floating around about paystubs. Some people think they’re optional, while others believe they’re only for full-time employees. The truth is, every worker deserves transparency in their earnings, and your Kelly Services paystub is no exception. Here’s a quick rundown of some common misconceptions:

- Myth 1: Paystubs are only for permanent employees. Nope! Even temps and contractors should receive detailed pay records.

- Myth 2: You don’t need to check your paystub regularly. Wrong! Regular checks help catch errors early.

- Myth 3: Paystubs are complicated and hard to understand. Not true! With the right guidance, you can decode them in no time.

How to Access Your Kelly Services Paystub

First things first: how do you even get your hands on that paystub? Kelly Services makes it pretty straightforward. Here’s a step-by-step guide:

- Log in to your account: Head over to the Kelly Services portal and log in using your credentials.

- Go to the payroll section: Once logged in, navigate to the “Payroll” or “My Pay” tab.

- Download your paystub: Look for an option to view or download your paystub. It’s usually available as a PDF.

Can’t find it? Don’t panic. Sometimes tech glitches happen. Reach out to Kelly Services customer support for assistance. They’re usually pretty responsive and can help you locate your paystub in no time.

Troubleshooting Common Issues

What if your paystub isn’t showing up? Or if the numbers don’t seem right? Here’s how to troubleshoot:

- Check your email: Sometimes paystubs are sent via email instead of the portal.

- Verify your account info: Make sure your login details are correct and up-to-date.

- Contact support: If all else fails, give Kelly Services a call. They’ll walk you through the process.

Decoding Your Kelly Services Paystub

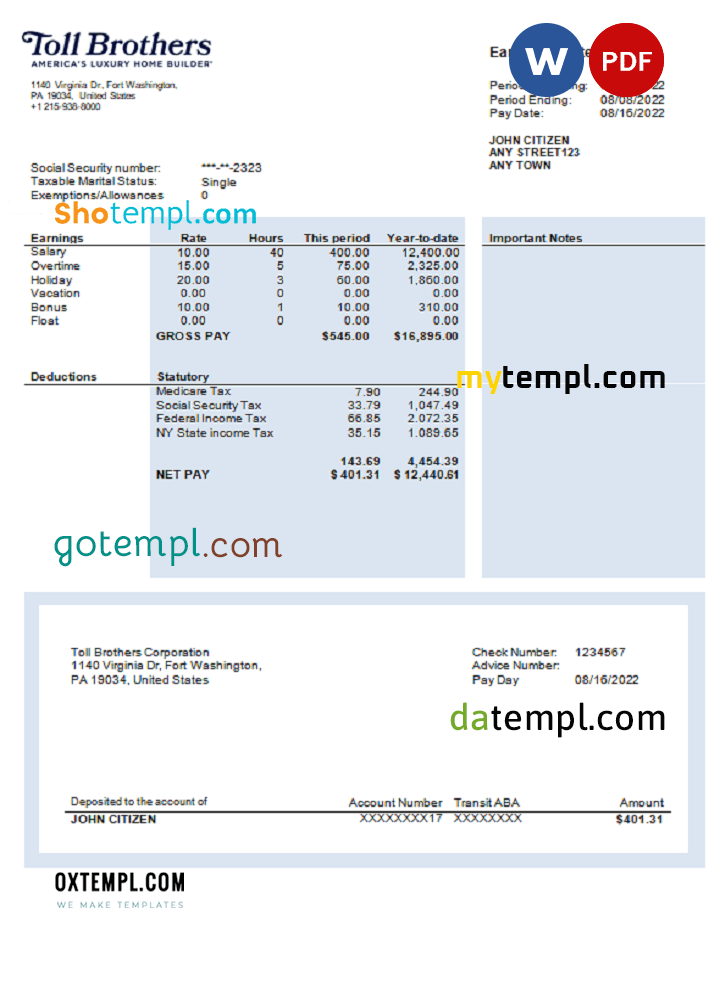

Now that you’ve got your paystub, let’s talk about what all those numbers mean. At first glance, it might look like a bunch of random figures, but each line has a purpose. Here’s a breakdown of the key sections:

Gross vs. Net Pay

Gross pay is the total amount you earned before deductions. Think of it as your pre-tax salary. Net pay, on the other hand, is what you actually take home after taxes, insurance, and other deductions. It’s the number you really care about because it’s the cash hitting your bank account.

Understanding Deductions

Deductions can be confusing, but they’re important. Here’s what you might see:

- Federal and state taxes: These are mandatory and vary depending on your location and earnings.

- Health insurance: If you’re enrolled in Kelly Services’ health plan, this will show up as a deduction.

- Retirement contributions: Any 401(k) or retirement plan contributions will also appear here.

Common Questions About Kelly Services Paystubs

Let’s tackle some of the most frequently asked questions about Kelly Services paystubs. These answers will clear up any confusion and help you feel more confident about your earnings.

Can I Request a Hard Copy?

Absolutely! While most paystubs are digital these days, you can always request a printed version from Kelly Services. Just reach out to their support team and they’ll send one your way.

What If There’s an Error?

Mistakes happen, but they’re fixable. If you spot an error on your paystub, don’t hesitate to report it. Contact Kelly Services immediately and provide as much detail as possible. They’ll investigate and make the necessary corrections.

The Importance of Regular Paystub Reviews

Checking your paystub regularly isn’t just a good habit—it’s essential. By keeping an eye on your earnings and deductions, you can catch errors early and ensure you’re being paid correctly. Plus, it helps you stay on top of your finances and plan for the future.

Tips for Effective Paystub Reviews

Here’s how to make the most out of your paystub reviews:

- Compare with previous paystubs: Look for any discrepancies or unexpected changes.

- Double-check deductions: Ensure all deductions align with your expectations.

- Keep records: Save your paystubs in a secure place for future reference.

How Kelly Services Paystubs Benefit You

Beyond just showing your earnings, Kelly Services paystubs offer several benefits. They provide a clear record of your work history, help with tax filings, and serve as proof of income when needed. Plus, they give you peace of mind knowing exactly where your money is going.

Using Paystubs for Financial Planning

Your paystub isn’t just a financial snapshot—it’s a tool for planning. By analyzing your earnings and deductions, you can create a budget, save for emergencies, and even invest in your future. It’s all about taking control of your finances and making smart decisions.

Tips for Maximizing Your Earnings

Want to make the most out of your Kelly Services job? Here are some tips:

- Negotiate your rate: Don’t be afraid to ask for a higher pay rate if you feel you’re worth it.

- Optimize deductions: Review your deductions and see if there are ways to reduce them.

- Take advantage of benefits: If Kelly Services offers additional perks, like health insurance or retirement plans, consider enrolling.

Conclusion: Empower Yourself with Knowledge

By now, you should have a solid understanding of how to access, interpret, and make the most out of your Kelly Services paystub. Remember, your paystub is more than just a record of your earnings—it’s a tool for financial empowerment. Regularly reviewing it can help you catch errors, plan for the future, and ensure you’re being paid fairly.

So, take charge of your finances today. Dive into your paystub, ask questions if needed, and don’t hesitate to reach out to Kelly Services for assistance. And hey, if you found this guide helpful, why not share it with a friend or drop a comment below? Knowledge is power, and the more we share, the stronger we all become!

Table of Contents

- How to Access and Understand Your Kelly Services Paystub: The Ultimate Guide

- Why Understanding Your Kelly Services Paystub Matters

- Common Misconceptions About Paystubs

- How to Access Your Kelly Services Paystub

- Troubleshooting Common Issues

- Decoding Your Kelly Services Paystub

- Gross vs. Net Pay

- Understanding Deductions

- Common Questions About Kelly Services Paystubs

- Can I Request a Hard Copy?

- What If There’s an Error?

- The Importance of Regular Paystub Reviews

- Tips for Effective Paystub Reviews

- How Kelly Services Paystubs Benefit You

- Using Paystubs for Financial Planning

- Tips for Maximizing Your Earnings

- Conclusion: Empower Yourself with Knowledge

Detail Author:

- Name : Prof. Lawson Johns

- Username : freda09

- Email : zgleason@hotmail.com

- Birthdate : 1979-03-09

- Address : 759 Price Mountains Todstad, WY 25480

- Phone : (636) 746-9694

- Company : Kuphal, Weber and Gorczany

- Job : Tailor

- Bio : Omnis laudantium nesciunt id molestiae rem maxime. Ipsam sed dicta accusantium inventore praesentium aut. Maxime praesentium porro sed voluptatibus hic.

Socials

linkedin:

- url : https://linkedin.com/in/malvina_leffler

- username : malvina_leffler

- bio : Explicabo dolores libero est inventore quia.

- followers : 218

- following : 447

instagram:

- url : https://instagram.com/malvina.leffler

- username : malvina.leffler

- bio : Consequatur veniam aut ut ipsum voluptatem. Quia rerum qui quis corrupti.

- followers : 3177

- following : 259

tiktok:

- url : https://tiktok.com/@lefflerm

- username : lefflerm

- bio : Magni et ut nisi deserunt. Quisquam dolorem vitae ratione.

- followers : 4507

- following : 673

facebook:

- url : https://facebook.com/malvina_dev

- username : malvina_dev

- bio : Esse veritatis et aut qui voluptate similique minima.

- followers : 3838

- following : 2348